Embarking on your crypto trading journey? Before diving in headfirst, you’ll want to equip yourself with risk management tips for beginner traders in crypto. These foundational principles are crucial for ensuring long-term success and financial stability. This guide aims to give you a comprehensive overview of how to minimize your risks while maximizing gains.

Money Management in Crypto Trading: Where Caution Meets Strategy

Rule number one in the world of crypto trading is to limit your risk. A good guideline is to only risk 2-3% of your total portfolio on a single trade. Small, manageable losses are far better than large, devastating ones.

While the crypto market is open 24/7, that doesn’t mean you have to be. Cancel any unfilled trades before you head to bed—you can always trade when you’re awake and alert.

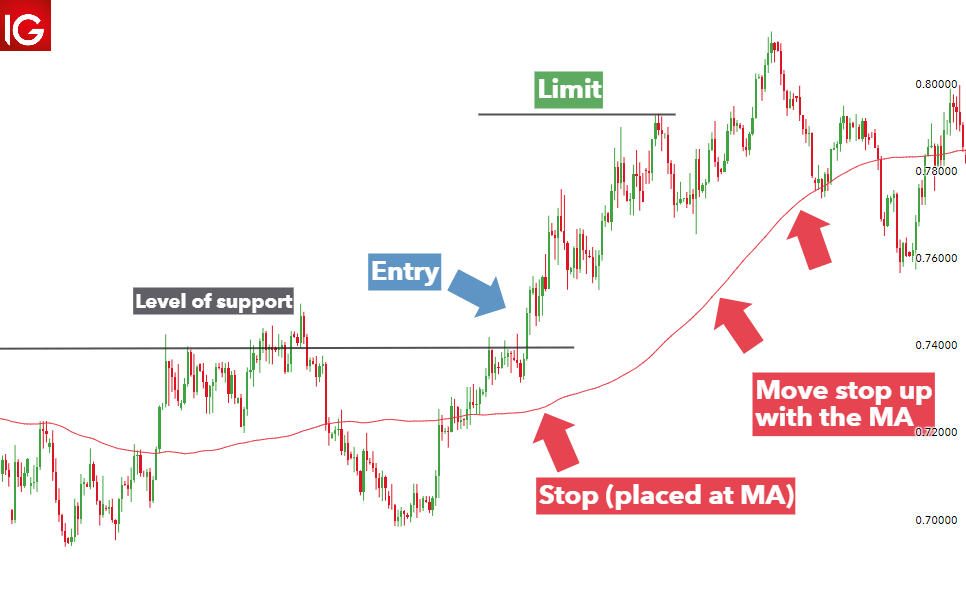

Take Profit (TP) levels can be helpful, but they’re not the be-all and end-all. Trust your instincts and use them as one of many tools in your trading arsenal. Your stop loss is another essential tool; consider it your safety net and use it wisely.

It’s easy to get carried away with the excitement of trading, but try to keep it simple. Limit yourself to two open trades at any given time. Anything more can lead to emotional, rash decisions, hindering effective money management in crypto trading.

Finally, don’t underestimate the power of a trading journal. Document your trades, your thought processes, and, most importantly, your mistakes. Trading is a learning curve; embrace it. Also, remember to do your homework. Never follow anyone blindly and invest time in educating yourself through various trustworthy resources.

Read our latest Guides: