Introduction to Trading

Are you new to the world of trading and feeling overwhelmed? You’re not alone, and you’re exactly where you need to be. This trading guide for beginners is your essential roadmap for understanding the nuances of long positions, short positions, and the high-stakes game of leverage.

In the trading arena, “going long” is the strategy you’ll hear about most often. When you opt for a long position, you’re buying an asset with the expectation that its price will rise over time. The endgame? Selling it at a higher price and pocketing the difference. But be warned, if the asset’s price takes a nosedive, you’ll incur a loss.

What is Long and Short in Trading Crypto: A Quick Overview

The opposite of going long is—you guessed it—”going short.” This strategy involves borrowing an asset to sell immediately, with the hope of buying it back at a lower price later. However, if Lady Luck isn’t on your side and the asset’s price surges, you’ll find yourself buying it back at a higher cost, resulting in a loss.

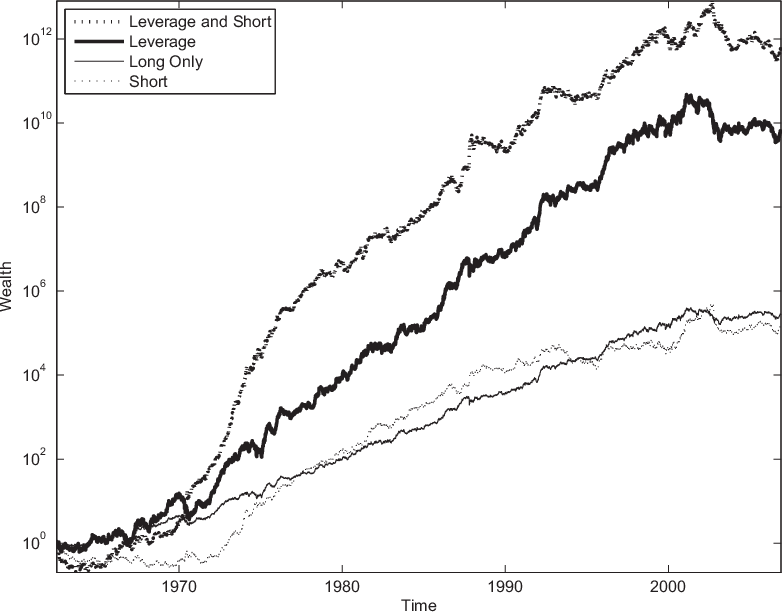

Leverage can be your best friend or your worst enemy in trading. Essentially, leverage allows you to magnify the size of your trade by borrowing money. For example, applying 2x leverage to a $100 trade effectively turns it into a $200 trade. While this amplifies your potential gains, it also magnifies your losses.

Related :

Risk and Reward: The Double-Edged Sword of Leverage

If you’ve ever heard the phrase “high risk, high reward,” it applies perfectly to leverage. Let’s say you use 10x leverage on a $100 trade. A mere 10% dip in the market could wipe out your entire investment. In some cases, the losses can even exceed your initial investment, leaving you indebted to the broker. To navigate these treacherous waters, consider using ‘Stop Loss’ orders. These will automatically exit your position at a predetermined price, limiting your potential losses.

No trading guide for beginners would be complete without emphasizing the importance of due diligence. There’s no substitute for solid research. Understand the asset you’re investing in, know the market conditions, and make decisions based on hard facts rather than hype or fear.

As you embark on your trading journey, this trading guide for beginners serves as your foundational manual. The strategies of going long and going short, coupled with the calculated use of leverage, can either make or break your trading experience. So take your time, do your research, and trade smartly.

Read Also :