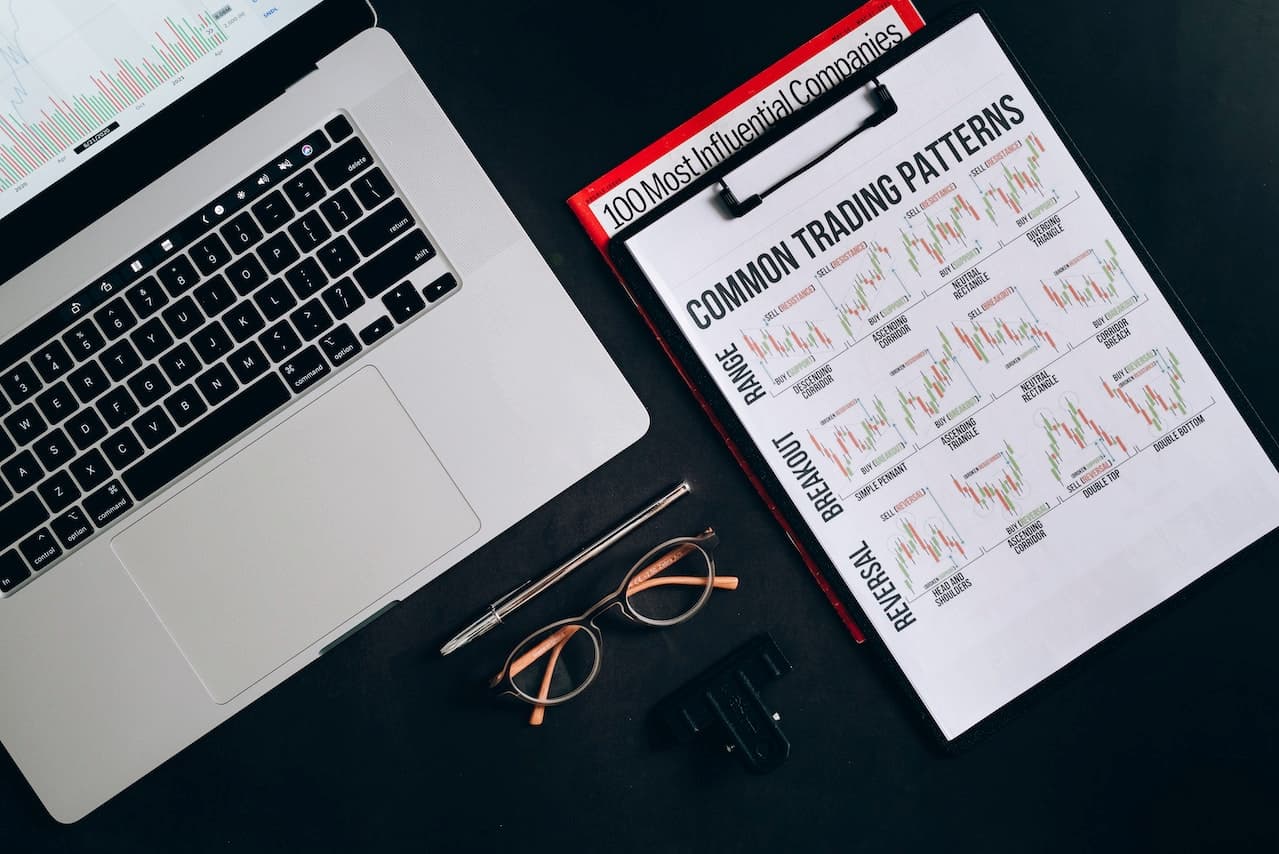

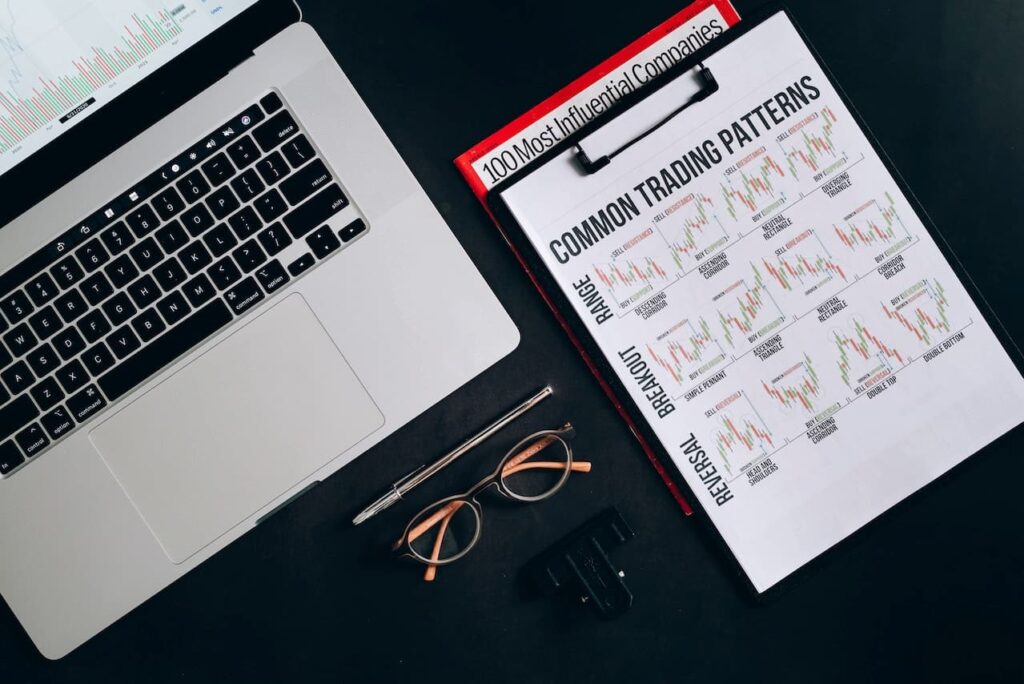

Navigating the complex world of trading can be akin to sailing through stormy seas. It’s easy to feel overwhelmed, but don’t worry, we’ve got you covered. In this guide, we’ve distilled the ocean of advice down to essential tips, creating the ultimate trade cheat sheet for smarter moves in the market.

Navigating the Complexities: Your Comprehensive Trading Cheat Sheet

When embarking on your trading journey, the first thing to remember is the importance of position limits. It’s tempting to go all in on a trade that looks promising, but one of the cardinal rules in any trading cheat sheet is to never allocate more than 2% of your total capital to a single trade. This isn’t just a suggestion; it’s the cornerstone of effective money management in trading.

Knowing yourself—your trading style, your risk tolerance—is just as crucial. In essence, your approach to trading should be an extension of your personality. Stick to it rigorously, as veering off could lead you into turbulent waters.

Now, imagine trading as sailing on a vast ocean. Staying updated with current events is your compass. Real-world events have a significant impact on market movements, and being news-savvy is essential, especially in day trading. That’s a tip you’ll find on any day trading cheat sheet.

Related:

- Guide for Rocky Trades in Crypto

- Avoiding Scams in Direct Messaging

- Will Shiba INU Reach 1 Cent 2023

- Google Stock Forecast 2023, 2025 – 2030

Diversification is another crucial point. It’s the practice of spreading your investments across various securities to mitigate risk. Think of it as having multiple sails; if one fails, the others can still keep you moving. This wisdom holds true across trading types, making it a key element in any technical indicators cheat sheet.

As you sail through the trading seas, your strategy serves as your map. Without a robust money management strategy, you’re essentially sailing blindfolded. This is particularly true when you’re following market trends. Your technical indicators need to be set in a way that minimizes the impact of market retracements, a staple point in any technical indicators cheat sheet.

Turning our attention to what not to do, it’s vital to know when to cut your losses. If a trade starts to sink and exceeds your risk tolerance, it’s better to cut it loose. Similarly, high-risk strategies, like the Martingale, may seem tempting but can lead to significant losses. These are risky waters best avoided.

Impulse trades are the sirens of trading—enticing but dangerous. Every move you make should be calculated and aligned with your overall strategy. Last but not least, be cautious of trading in low timeframes, especially in day trading, as transaction costs can quickly erode your profits.

In a nutshell, this trade cheat sheet serves as your navigator, guiding you through the complexities of the trading world. Whether you’re a novice looking for direction or a seasoned trader aiming to refine your skills, these distilled tips provide a sturdy foundation for a successful trading career.

Read Also :